Get Involved! Help Pass A Rule To Remove Class Action Bans In Arbitration Clauses

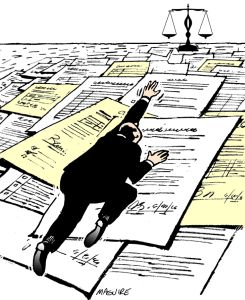

For years, companies have been stripping consumers’ access to justice and right to the courts by installing forced arbitration clauses deep in the fine print of their contracts. By forcing consumers into arbitration and banning them from the courts, companies have set up a rigged system where they are able to evade consumer laws and avoid accountability for their actions. A new proposed rule, however, seeks to limit the power of these arbitration clauses.

(Learn more about arbitration from the short film Lost in the Fine Print or by reading about it in the NY Times)

The proposed rule – issued by the Consumer Financial Protection Bureau (CFPB), a federal agency tasked with protecting consumers from unfair or abusive business practices – will make it illegal for a company extending credit to a consumer (think banks, credit card companies, payday lenders, car loan finance companies, etc.) to ban class action lawsuits in their arbitration clauses. If the rule is implemented, consumers can no longer be stripped of their right to band together in a class action lawsuit to fight common, company-wide abuses that impact a large number of consumers. The CFPB issued its proposed rule after an extensive, two-year study of arbitration and its impact on consumers.