New Mexico Will Not Enforce One-Sided Arbitration Agreements

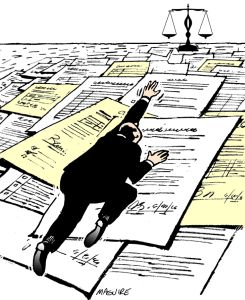

Arbitration agreements in contracts today have become ubiquitous. It’s difficult to find a contract that doesn’t have one: cell phone agreements, credit cards, car sales, you name it. Most consumers don’t even realize that they’ve agreed to arbitration when they sign a contract or simply do business with a company. Even if the consumer realizes that they’ll have to arbitrate – rather than have their day in court – they don’t realize the implications of arbitration, namely, that it can be extremely one-sided, favoring the deep-pocketed business over the individual consumer.

Luckily for us New Mexicans, New Mexico state courts have refused to enforce unfair arbitration agreements, striking down some of these agreements because they are so unfair and one-sided. Treinen Law Office – teaming up with Public Justice – has been at the forefront of this movement in New Mexico, as demonstrated by the recent New Mexico Court of Appeals decision, Dalton v. Santander Consumer USA.

If you’d like to read Dalton, click here.

So what is arbitration? Arbitration is an alternative to settling a legal dispute. Rather than going to court – where the dispute is resolved by a judge or a jury – the parties in arbitration use a third-party “arbitrator” to settle the matter. Arbitration is almost always binding, meaning, a consumer must live with the decision of the arbitrator and the consumer gives up their right to go to court. Many arbitration schemes are patterned after the judicial process – parties have to exchange information prior to the arbitration (similar to discovery), the arbitration is often similar to a trial with witnesses called and parties following the rules of evidence. However, there are often significant limits in arbitration. Parties often cannot take depositions or are limited in the number of depositions they can take prior to the arbitration (a key, pre-trial right in the courts), often the number of witnesses that can be called at arbitration is limited along with a host of other limitations. Another huge restriction in many arbitration schemes is a restriction on damages. A number of arbitration schemes limit the types of damages that a consumer can receive. For example, some schemes forbid punitive damages. That means that regardless of how egregious a company has acted, the arbitrator has limits on how much money they can award to the consumer.

To learn more about arbitration, click the following link to watch the short documentary film, Lost in the Fine Print.

In Dalton, the New Mexico Court of Appeals struck down an arbitration agreement in a car sales contract because it was unfairly one-sided in favor of the dealership. Dalton built upon another New Mexico that involved the Treinen Law Office, Rivera v. American General Financial Services, Inc. (check out our Opinions page for a link to Rivera). The arbitration agreement in Dalton allowed for the dealership to repossess the vehicle and to bring a lawsuit in small claims court, but it forced the consumer into arbitration if she wanted to bring a claim over $10,000. The Court held that this scheme was unreasonably one-sided because it allowed the dealership all the rights that it would normally assert if the consumer broke the contract, while it denied the consumer her one major right – suing the dealership – if the dealership cheated the consumer.

Thank you! This was brilliant and exactly what I needed!